Hedging Betting Exposure Using Crypto: A Strategic Guide

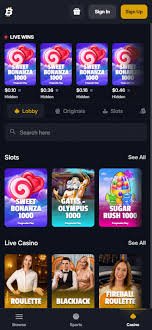

Betting can be a thrilling and potentially profitable endeavor, but it also comes with its fair share of risks. One effective way to mitigate these risks is through hedging. In recent years, the rise of cryptocurrency has introduced innovative methods for hedging betting exposure. In this article, we will explore how to effectively use crypto for hedging in the betting market. Whether you are a seasoned bettor or just starting, these strategies can help you manage risk and improve your betting experience. For more insights on betting platforms, visit Hedging Betting Exposure Using Crypto Derivatives Bitfortune.

Understanding Hedging in Betting

Hedging is a risk management strategy that is used not only in finance but also in the betting industry. It involves placing a bet on the opposite outcome of an existing wager to reduce potential losses. For instance, if you have a significant bet on Team A to win but you fear an upset, you might place a bet on Team B to minimize your risk. The goal of hedging is to create a safety net for your investment, allowing you to weather uncertainties while still participating in the game.

Why Use Cryptocurrency for Hedging?

Cryptocurrency offers unique advantages for bettors looking to hedge their exposure:

- Decentralized Nature: Unlike traditional currencies, cryptocurrencies operate on a decentralized network, providing anonymity and security.

- Speed of Transactions: Crypto transactions are processed quickly, allowing bettors to place hedging bets on the fly.

- Lower Fees: Betting with crypto can often result in lower transaction fees compared to fiat currencies.

- Global Accessibility: Cryptocurrencies allow bettors from different jurisdictions to place wagers without worrying about currency conversion.

Popular Cryptocurrencies for Betting

As with any investment strategy, it’s important to choose the right cryptocurrency for betting. Here are some popular options to consider:

- Bitcoin (BTC): The original and most widely-accepted cryptocurrency, Bitcoin is often considered the gold standard in the crypto world.

- Ethereum (ETH): Known for its smart contract functionality, Ethereum offers faster transactions than Bitcoin, making it an attractive option for bettors.

- Litecoin (LTC): Often referred to as the silver to Bitcoin’s gold, Litecoin provides faster confirmation times and lower fees.

- Stablecoins: Cryptocurrencies like USDT (Tether) and USDC (USD Coin) are pegged to the US dollar, offering a stable value for betting without the volatility of other cryptos.

Strategies for Hedging with Crypto

Let’s delve into some strategies bettors can employ to hedge their exposure using cryptocurrency:

1. Placing Dual Bets

One straightforward method of hedging is to place bets on both sides of an event. For example, if you have a strong inclination toward Team A winning, but the odds change unfavorably, you could place a bet on Team B using cryptocurrency. This way, no matter the outcome, you can recover part of your investment.

2. Arbitrage Betting

Arbitrage betting involves taking advantage of the different odds offered by various bookmakers. By placing bets on all possible outcomes with different platforms, you can ensure a profit regardless of the result. Using crypto for these transactions allows for fast execution and minimal fees.

3. Utilizing Crypto Betting Exchanges

Certain platforms allow users to bet against others in a peer-to-peer environment. These crypto exchange platforms facilitate hedging opportunities by enabling bettors to set their own odds. This method gives you more control over your betting strategy.

4. Setting Stop-Loss Orders

Some crypto betting platforms allow you to set stop-loss orders, which automatically place opposing bets when the odds reach a certain threshold. This automation can help you hedge especially volatile positions.

Potential Risks and Challenges

While hedging can minimize losses, it’s essential to recognize the potential risks associated with this strategy:

- Over-Hedging: Betting on both sides of an event may lead to reduced profits or even losses if not managed carefully.

- Market Volatility: The value of cryptocurrency can fluctuate significantly, which may affect your betting outcomes.

- Platform Reliability: Not all crypto betting sites are created equal. It’s crucial to choose reputable platforms to mitigate risks.

Conclusion

Hedging betting exposure using cryptocurrency presents a unique and effective method for managing risk in sports and other betting markets. By leveraging the speed, security, and efficiency of crypto transactions, bettors can implement various strategies to safeguard their investments. However, responsible betting is crucial, and bettors must remain aware of the potential risks associated with both hedging and cryptocurrency. With the right approach, you can enhance your betting experience while keeping your risks in check.